Investment Philosophies

Tax Sheltered Investing

Structure

Optimize the mix of tax status and asset location to produce the most desirable tax impact both for your present needs and future needs.

Business Owner Specific

Tax sheltered retirement investing and employee benefits to maximize value for both owners and employees.

Company Stock Analysis

Disposition and diversification strategies for concentrated stock/options holdings.

Opportunistic

Tax free investment optimization and implementation. If you've been told you make too much to contribute to Roth IRAs you may only have half the story.

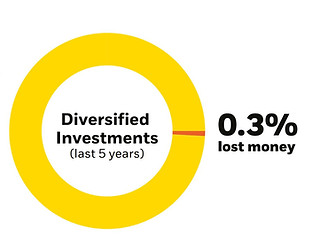

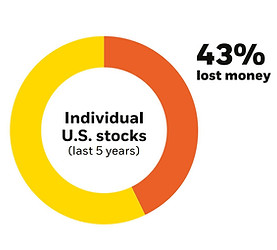

Diversify your way

to a better portfolio:

When you invest in individual stocks, you are exposed to both market risk and company risk. While market risk (i.e., the risk of the S&P 500 or similar index) has usually been rewarded with return, company risk has been more unpredictable, which is why 43% of individual stocks lost money over the last five years, while only 0.3% of diversified investments lost money over the same time frame. Without a crystal ball, it’s impossible to know for sure which stocks will outperform in the future.

Source: Morningstar as of 12/31/24. Diversified investments are represented by the Morningstar U.S. Equity Category, oldest share class only. Individual U.S. stocks are represented by the Morningstar U.S. Stock Universe, all securities on the NYSE

and NASDAQ. Analysis does not include obsolete mutual funds, ETFs or stocks as defined by Morningstar. Past performance does not guarantee or indicate future results.